1885, "State Geologist of Pennsylvania warned that 'the amazing exhibition of oil was only a 'temporary and vanishing phenomenon, one which young men will live to see come to its natural end'" (Yergin, p229)

1914, "Oil reserves would be exhaused by 1924" (Bureau of Mines)

1939, "The world has 13 years of petroleum reserves" (Interior Department)

1951, "The world had 13 years of proven reserves" (The Interior)

1970, "The world's proven oil reserves were an estimated 612 billion barrels"

1977, "Mankind could use up all the proven reserves of oil...by the end of the next decade" (Carter).

2005, "Peak oil was suppost to arrive by Thanksgiving 2005. Then the 'unbridgeable supply demand gap' was expected to open up 'after 2007'" (Deffeyes p3, Yergin, p227)

2006: "Proven reserves were 1.2 trillion barrels".

Today: Shale rock in Texas, Lousisiana, Montana, North Dakota, NewYork, Pennsylvania, may contain 2,000 trillion cubic feet of natural gas.

What Has Happened

- Oil went from $10/barrel in 1999 to about $100/barrel today.

- Production was 73 mbpd in 2004. Annual average expenditures on oil exploration doubled from 2004 to $600 billion in 2012 to reach 75 mbpd.

- U.S. employment has yet to reach its 2008 levels. Economies like Greece and Spain have collapsed by as much as 25 percent.

- Deep water wells deplete at about 10-20% a year.

- Tight oil depletes at about 40% during the first few years. (Stephen Hren)

The Warnings

"For decades, we have known the days of cheap and easily accessible oil were numbered. For decades, we’ve talked and talked about the need to end America’s century-long addiction to fossil fuels. And for decades, we have failed to act with the sense of urgency that this challenge requires." (Obama)

"One day we will run out of oil. It will not be today or tomorrow, but one day we will run out of oil and we have to leave oil before oil leaves us, and we have to prepare ourselves for that day," (Dr. Fatih Birol ,IEA)

"My sense is that we're nearing an endgame for the modern age. I think we had two singular events in the last 18 months that signal the end. First, in July 2008 the price of oil hit $147/barrel. Food riots broke out in 30 countries, the price of basic items shot up and purchasing power plummeted. That was the earthquake; the market crash 60 days later was the aftershock." (Jeremy Rifkin, The Empathic Civilization, 17 February 2010)

"Peak oil will arrive; the question is simply one of timing. It will probably be sooner than most people expect and definitely sooner than many would prefer. In an ideal world, governments would anticipate this development and plan for it; the alternative is a laissez-faire scenario likely to impose high economic costs in terms of stagflation and lost output." (David Ingles and Richard Dennis, 13 September 2010)

“We cannot keep going from shock when gas prices go up to trance when gas prices go back down,” he said. “We can’t rush to propose action when prices are high then push the snooze button when they go down again. We can’t keep doing that. The United States of America cannot afford to bet our long-term prosperity and security on a resource that will eventually run out.” (Obama, 30 March 2011)

"Instead of building the machines we will need to support ourselves as energy supplies decline, we continue to use the steel, glass, electronics, and energy to build the old economy." (Gail the Actuary, TOD, 1 October 2009).

Quote:

Excerpts of Carter's speech, April 18 1977

Tonight I want to have an unpleasant talk with you about a problem unprecedented in our history. With the exception of preventing war, this is the greatest challenge our country will face during our lifetimes. The energy crisis has not yet overwhelmed us, but it will if we do not act quickly...We must not be selfish or timid if we hope to have a decent world for our children and grandchildren.

We simply must balance our demand for energy with our rapidly shrinking resources. By acting now, we can control our future instead of letting the future control us...Our decision about energy will test the character of the American people and the ability of the President and the Congress to govern. This difficult effort will be the "moral equivalent of war" -- except that we will be uniting our efforts to build and not destroy...

The world now uses about 60 million barrels of oil a day and demand increases on average each year about 5%. This means that just to stay even we need the production of a new Texas every year, an Alaskan North Slope every nine months, or a new Saudi Arabia every three years. Obviously, this cannot continue...

We can't substantially increase our domestic production, so we would need to import twice as much oil as we do now. Supplies will be uncertain. The cost will keep going up. Six years ago, we paid $3.7 billion for imported oil. Last year we spent $37 billion -- nearly ten times as much -- and this year we may spend over $45 billion.

PBS American Experience, Jimmy Carter

|

Quote:

"The peaking of world oil production presents the U.S. and the world with an unprecedented risk management problem. As peaking is approached, liquid fuel prices and price volatility will increase dramatically, and, without timely mitigation, the economic, social, and political costs will be unprecedented. Viable mitigation options exist on both the supply and demand sides, but to have substantial impact, they must be initiated more than a decade in advance of peaking."

Robert L. Hirsch, Ph.D.

|

Quote:

"The Peak Oil Debate Is Over"- If something cannot be sustained, it will eventually not be sustained… ultimately it will shrink.

- you cannot produce oil unless you first discover it (a contribution by Colin Campbell).

- A resource that is finite cannot continually have its production increased.

"We remain heavily dependent on super-giant and giant oilfields discovered in the 50s and 60s of the last century… Only rarely in recent decades have discoveries equaled production. Mostly, it’s been one barrel discovered for every three barrels produced...old super-giants like Burgan in Kuwait and [Cantarell] in Mexico have gone into decline earlier than had been anticipated… and going into decline have been Alaska, the North Sea, western Siberia and the like...Even the Ghawar oilfield is increasingly hard to sustain...Next, given projected decline curves running from 4 to 6 percent, and the projected increase in demand during the next quarter century, we shall require the new capacity equivalence of five Saudi Arabias."

Dr. James Schlesinger, ASPO-USA, 01 November 2010

|

Quote:

German military study warns of potential energy crisis

"...warns of the potential for regional shortages, market failures, and a shift in political power toward those capable of exporting oil...95% of all industrial outputs is dependent on oil as a fuel and/or as a chemical base for polymer production etc. Oil has become a key driver of modern lifestyle and globalization...within a timeframe until the year 2040, a changed international security layout based on new risks (including transport risks for fuels) and new roles of actors in a possible conflict around the distribution of increasingly scarce resources...expect a reduction of “free market” mechanisms in oil trade, and a rise in more protectionism, exchange deals, and political alliances between suppliers and customers...[expect] a reduction of the importance of “Western values” related to democracy, and human rights in the context of politically motivated alliances, which increasingly are driven by emerging economies such as China – likely leading to double standards. Emerging economies are equally expected to receive higher recognition in international organizations, particularly those with strength in resources (such as Russia)...Systemic risks after reaching a 'tipping point'”

Robert Rapier, Energy Bulletin & TOD, 2 Sep 2010

Der Spiegel

|

World Totals and Peak Production

Peak production is when resources become ever more difficult and expensive to extract so the flow rate begins to decline. It's when we use the low hanging fruit first and save the harder stuff for later. The peak will occur long before all the oil has been pumped from the ground. For a single well that has been profitable, this generaly happens at the halfway point, when 50% of it's recoverable resources have been extracted. The pressure drops and the flow decreases unless some additional energy is put in to keep flow up such as using a pump jack, injection, etc. Now imagine the thousands of producing wells around the world. Some are new, some are at peak production, and others are older wells in decline. When percentage of old to new is great enouf, world prodiction goes down even as newsworthy new ones are put on line. The peak of world oil discoveries was in 1965, and oil production per year has surpassed oil discoveries every year since 1980 putting us further and further in the difficult zone called tough oil.

World crude oil production was on a century-long rising trend from less than 1 mbd in 1900 to nearly 75 mbd today. (

The Hill), giving us the impression of and endless energy bounty that could be exploited in ever greater quantities by just will power and new technology. It appears, however, that concentional production had topped out a around 2004-2005 and has been at an inelastic undulating plateau within 5% of the peak despite the push of fuel prices that have tripled within the last decade.

Recent models now perdict a terminal decline sometime around 2015 - 2020. Rising fuel prices can still cause total world production to grow short-term as new lower ERoEI inputs from expensive unconventinal oil replace the cheap conventional oil. But much of this new oil will not be profitable, so a longer term decline will set in even though we have used only about 10% of the world reserves.

The grand total of the world's conventional oil supply is estimated to be about 2.013 trillion barrels, though it continues to go up a bit as new supply is found and advancing technology gets more production from older fields. The figure was 1.35 trillion in 2010. We have consumed about 50%, and around 90% of that 50% in the last 50 years. Today we are consuming 86 mbpd; 74 + extra heavy oil, tar sands, etc. In 2009, world demand went down on accout of the Great Recession, but has since rebounded and is expected to reach record levels this year.

In 1969, M. King Hubbert, a geologist who worked for Shell, drew a bell curve called Hubbert's peak or Hubbert's curve which is the sum of many extraction curves for individual wells where P = production and Q = cumulative production. They can be plotted along a straight line, Y = mx + a which is the same as y = mx + b. We let x = Q, y = ratio P/Q and a = the P/Q intercept giving us P/Q = mQ + a. Where the line intersects the P/Q axis, P/Q is highest and Q = 0. Where the line intersects Q we have the maximum cummulative production, Qt, which is about 2 trillion barrels and P/Q = 0. From this line we derive the the symmetrical bell curve that illustrates the rise and fall of production. P/Q = mQ + a, and t = years. P/Q = -aQ/Qt +a, P/Q = a(1 - Q/Qt), P = a(1 - Q/Qt)Q. The area below the curve is cummulative production. He put peak-oil at the year 2000. Deffeyes places the moment on Thanksgiving day 2005. The Wiki graph:

World Production shows there is not much to expect in the way of increases after 2010. We could already be on the downside of the curve. Some rough times ahead - greater demand for dwindling oil resurves. As of 11 December 08, I'm paying $1.77 a gallon.

World Oil Production (TOD, November 2009)

The End of Cheap Oil (Scientific American, 1998)

The smooth well behaved deterministic mathematical system/model becomes asymmetrical after the addition of non deterministic inputs outside the boundries of the origional equation. These can be political forces, economic factors, war or advances in technology. For example, in 1973, the increases in price motivated the United States and other nations to begin conservation efforts to reduce dependence and increase domestic exploration. As of 2012, we are using 2.5% less gasoline then we were last year, ending a trend of increasing consumption.

Oil Discoveries and Oil Consumption

Neverthless, we have our work cut out for us. While we have used up half the liquid fuels in a 100 year time, at the current rates of consumption, the remainder will be gone in 35 years. If you accept 1,350 billion, we have a 44 year supply. The first half was the easy to get high ERoEI land based oil found in the 30s through the 60s. The other half is more expensive and of lower quality. It will be in remote, deeper, smaller and less productive deposits including the arctic; beginnig a cycle of diminishing returns. We will be confrunted with falling ERoEI, meaning we get ever less energy out of the system then what we put in until it's no longer viable to pump it out of the ground. This is the journey from the top of the Resource Pyramid to the Bottom. Where we go from highly concentrated low sulfer to low concentrations that are laced with toxens. At what point this is going to happen, I do not know, but we will hit it before we use up the 2nd trillion.

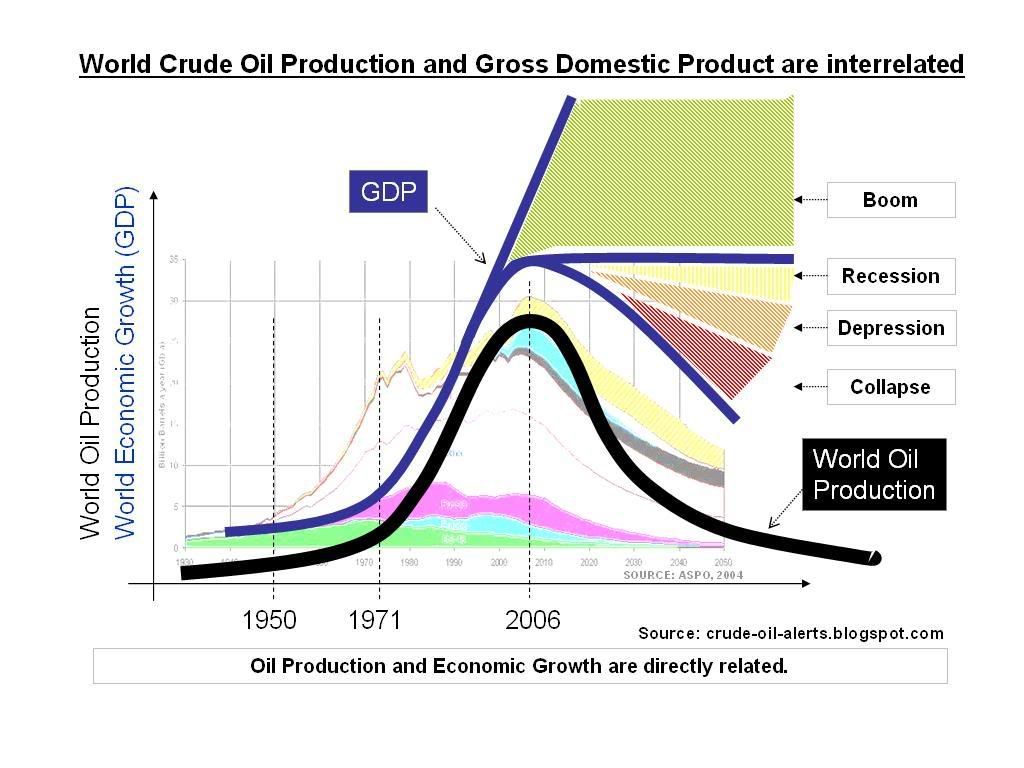

The Boom-Bust Model

George Soros constructs a financial model that peaks and declines very much like the oil one. The bubble begins with an unrecognizable upward trend, a period of acceleration; a period of testing and setback. Then there if there is survival of the testing phase, growth resumes. Then there is a point when reality can no longer sustain the expansion, a twilight period when the game is still played followed by a tipping point and catastrophic downward acceleration (Soros, pp 66,67). The setback before growth marches on is the most striking part: The 1973 OPEC oil embargo made us switch to smaller more fuel efficient cars. Then the oil problem went away and we ended up driving even bigger SUVs.

What we have

Breakdown of

Total Oil Reserves:

Conventional Oil - 30%

Heavy Oil - 15%

Extra Heavy Oil - 25%

Oil Sands - 30%

Oil Shale (kerogen) 3 trillion BOE, cost $90 a barrel, must be heated to 700 deg for 2 weeks.

Coal 1.5 trillion BOE, 1,650 pounds CO2 vs 947 pounds for conventional oil.

Heavy Oil 1 -2 trillion BOE, 4.5 barrels of water to 1 barrel of oil. CO2 20% over crude.

Ultra-Deep Offshore 0.1 - 0.7 trillion BOE, pressures up to 2000x sea level.

Natural Gas 1 trillion BOE, Fracking fluids contain toxens.

Enhanced Oil Recovery 0.5 trillion BOE,

Data: Popular Science, July 2011, pp46-55

Reserve-to-production (R/P) in years

United States - 11

Canada -28

Venesuela, Iraq, Iran, Emirats, Arabia - 100

Rising Prices

In the 90's, oil averaged $20 a barrel. Now, in 2009, a new floor of $70 is necessary to fund new deep offshore projects. Higher prices are not only due to supply and demand. In 2008 the average was $99. Bloomberg perdicts 2011 it will be around $87. As I update this in 2011, I could be higher.

1. Land based: $10.

2. Shallow offshore: $15-25

3. Enhanced onshore: $30

4. Enhanced shallow offshore: $40

5. Deep offshore $50-$70

6. Oil sands $60-80

7. Ultra deep offshore: $70-$90

Credit: Buster Cangney, The Oil Drum, 13 October 2009.

"State oil company Petrobras is a case in point. Last year the company discovered vast deepwater reserves that it is developing with a five-year 174 billion investment program. The goal is to double Brazil's production to 3.5 million barrels a day by 1012, making the country a top oil exporter. 'Our deepwater discoveries diden't just fall from the sky. They're the product of a very long-term development program going back 30 years.' says Petrobras CEO Jose Sergio Gabrielli de Azevedo. 'It's the Brazilian equivalent of sending a man to the moon'" (Business Week, 17 August 2009).

Another example of diminishing returns is a recently discovered oil field in the Gulf of Mexico known as 'Jack' which lies in an ultradeep region "175 miles off the coast of Louisiana below 7,200 feet of water and another 30,000 feet under the seabead...an oil patch holding 3 - 15 billion barrels of crude; the largest discovery in the US since 1968" However, "the deeper and further offshore you go to find oil, the bigger the technological and financial hurdles: temperatures 'down hole' gets ever hotter; the pressures more intense, the sea gets rougher, and...placing the drill in the right location gets more and more remote...Anchors can't be used to moor drilling vessels at these depths...the thruster solution keeps the rig 'on station' with six inches in any direction...but carries an energy burden: these 9,500-horsepower engines use a combined total of 27 megawatts of power when running at full capacity - enough power 20,000 homes. Total system power requires 40,000 gallons of diesel per day." (Little, pp 3-9)

“'We’re drillin’ three miles down in the Gulf of Mexico because of peak oil,' drawled Jim Baldauf, former Texan oilman and organiser of the conference. 'We’re scrapin’ the bottom of the barrel, so to speak. We have to drill twice as deep at twice the cost to get half what we’re used to.'” )PeakOil.com, 2 November 2010)

Historical ERoEI

1930's - 100:1

1970's - 40:1

2005 - 14:1. (Little, p 10)

Thermodynamics and diminshing returns in action. The oil age will end with lots of oil still in the ground.

Fuel Source Energy Profit Ratio*

1970 U.S. oil production; 30

Today’s U.S. oil production; 15

Oil sands oil production; 3

Corn ethanol; 1-1.5

Hydrogen from Water; <<1

(

Energy Bulletin, 2 Aug 2012)

So How Much is Left?

We have used about one trillion barrels of oil. Estimates of total original oil in place on earth range from 2 trillion barrels to 4-5 trillion, depending on how much effort, energy, and money we can spend to recover it. Our first trillion was the easy to exploite low hanging fruit. The rest is deep beneath the ocean floor, under the Arctic ice; low grade deposits like the oil sands in Alberta and the Orinoco Basin of Venezuela; the low grade oil shales of the Green River Basin in Colorado and Utah.

The current estimates in years:

Coal - Reserves 251, Resources 360

Nature gas - Reserves 64, Resources

Oil - Reserves 41, Resources 125

Nuclear (Uranium) 82, 300 - 10,000

(Science, p786, 13 August 2010)

Off Shore Drilling

Off Shore Drilling

"As long as the amount of energy needed to get energy continues to increase, the supply of net energy to society will decrease, despite that fact that the gross supply of oil may stay constant or even slightly increase in the short term." (David Murphy, TOD, 12 June 2010)

"In 1985 only 21 million barrels, or 6% of the oil produced in the Gulf of Mexico, came from wells drilled in water more then 1,000 feet deep. In 2009 such wells produced 456 million barrels, or 80 percent of total gulf production. Today, deepwater gulf wells account for about one quarter of the oil the U.S. sucks from the earth" (Daniel Gross, Newsweek, 14 June 2010)

"The quantity of oil, gas, coal or any other energy bearing resource that is left in the Earth is not the question, all that matters is that portion that can be exploited at a significant energy profit" (Natalie Angier,

The Cannon)

OPEC - Organization of Arab Petroleum Exporting Countries.

R/P or RPR - Reserves to Production Ratio. The remaining amount of a non-renewable resource: (amount of known resource) / (amount used per year).

The Streight Line

Slope–intercept form y = mx + b where m = slope = rise/run = y2 - y1/x2 - x1 = Δy/Δx, b = y-intercept

General form Ax + By + C = 0 where A,B ≠ 0, x-intercept = -C/A, y-intercept = -C/B, m = -A/B

Standard form Ax + By = C

Point–slope form y - y1 = m(x - x1)

Two-point form y - y1 = ((y2 - y1)/(x2 - x1))(x - x1)

Intercept form x/a + y/b = c where x-intercept = a, y-intercept = b

Through the origin y = mx

The Derivative

Can be written as: dy/dx, df/dx, df(x)/dx, f'(x) or y'

y = mx + b where m = Δy/Δx.

A measure of how a function changes as its input changes; how much one quantity is changing in response to changes in some other quantity.

Newton's Method of Fluxions (1671, 1736):

y = x² + x + 2; (y + 0y) = (x + 0x)² + (x + 0x) + 1; y + 0y = x² + x + 1 +2x(0x) + 1(ox) + (ox)²;

0y = 2x(ox) + 1(ox) + (ox)²; 0y = 2x(0x) + 1(0x); 0y/0dx = 2x + 1.

The Geometrical Definition

General point: (x1,y1) = (x,f(x)), (x2,y2) = (x+h,f(x+h)); m = y2-y1/x2-x1 = (f(x+h)-f(x))/(x+h-x)

f'(x) = lim h→0 (f(x+h)-f(x))/h

for y = x²;

f'(2) = lim h→0

The Physical Concept

Average Velocity = Distance from A to B/Time from A to B = Δ Distance/ΔTime.

Instantaneous Velocity = lim Δ→0 ΔDistance/ΔTime = lim Δ→0 (A+ΔTime-f(A))/ΔTime

Calculating Δf(x); Rate of change = Δf(x) / Δx

let f(x) = x²; at x: f (x) = x²; at x+Δx: f (x+Δx) = (x + Δx)²;

The difference is Δf(x) = f(x + Δx) - f(x); Δf(x) = (x + Δx)² - x²;

Expanding Δf(x) = x2 + 2xΔx + Δx² - x2;

Simplify Δf(x) = 2xΔx - Δx²

lim Δx → 0 2x + Δx = 2x

Bibliography

Amanda Little,

Power Trip, HarperCollins, 2009

James Howard Kunstler,

The Long Emergency, Grove Press, 2005

Back to

The Oil Post

Linear Mode

Linear Mode